Ensuring Buckner's Long-Term Commitment to Children

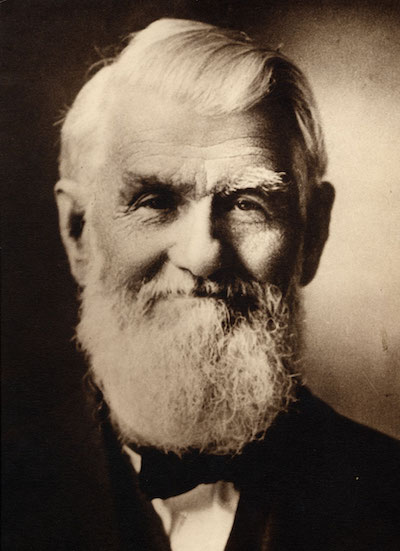

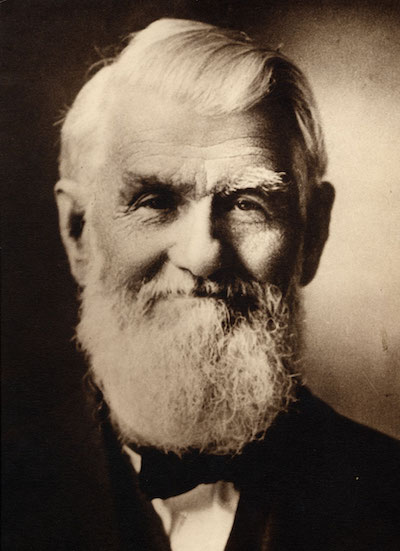

R.C. "Father" Buckner

Ever since 27 deacons met around a big oak tree in 1879 and each contributed $1 into a hat passed by R. C. “Father” Buckner, caring for the children and families we serve has been made possible by committed donors with big hearts. Over the years, giving to Buckner has taken many forms, from outright gifts to more sophisticated planning tools that can also provide substantial benefits to our donors and their families. This exceptional group of Buckner donors has taken the time to plan carefully about how and what they choose to give, and we are grateful to recognize them as members of The Good Shepherd Society.

There are many potential advantages to exploring options for planned giving, for both our donors and for Buckner.

By initiating estate gifts to Buckner from wills, trusts, life insurance, retirement plans and financial assets, our donors and their families have also benefited personally by using strategies that can provide a lifetime income or other financial and tax benefits.

Please explore the stories below for actual examples of how some very wise and generous donors have created giving plans for Buckner that also fit their own personal and financial goals. We are grateful that they are willing to share their stories and we have modified their names to respect their privacy.

Endowment Fund - Martha+

Martha loved her parents very much and cared for them faithfully in their retirement years. After they passed away, she decided to honor their memory by contributing their home to Buckner to set up a generous endowment fund. As the sole heir, Martha enjoyed a significant charitable deduction and was able to avoid the worries preparing, showing and marketing the home for sale. Even after many years, Martha continues to make annual contributions to the endowment fund honoring her parents. She knows that every penny of the annual income from the endowment makes a difference for those Buckner serves.

Charitable Gift Annuity - Charlotte+

Several years ago, Charlotte was touched by a specific article in our Buckner Today magazine. She reached out to a Buckner representative and chose to make a substantial outright gift to the project. As she pondered a second gift, she had concerns that the funds she considered donating might be needed by her children and grandchildren in the near future. Therefore, Charlotte chose to set up a Charitable Gift Annuity, which provides a generous monthly income for her children with future proceeds going to Buckner. Instead of setting up an estate windfall at her death, she chose to set up a series of gift annuities for them over the years, increasing their lifetime income each time yet making them ultimately responsible for managing their affairs. She loves knowing that she is caring for her own children very well, along with supporting Buckner families in the years to come.

Gift of Life Insurance - Carl and Beverly+

Life insurance gave Carl and Beverly peace of mind and the assurance that their small children would have adequate resources during their early years. However, after the kids grew up the policy was no longer needed, so Carl reached out to Buckner with an idea. He offered to transfer ownership to Buckner and continue making the annual premium payments. Because these were outright cash gifts to charity, they qualified for a charitable deduction. Years later, Carl and Beverly chose to make an additional gift to Buckner that paid off the policy and dramatically increased the death benefit. By using life insurance and funding it generously, they were able to significantly leverage the impact of their giving to benefit children supported through Buckner.

Charitable Remainder Trust - Adam and Susie+

Adam and Susie retired to a 300-acre ranch outside of Fort Worth where they loved entertaining, fishing and raising cattle while seeing their grandchildren grow and play. They both volunteered with a number of charities and hosted many events at their beautiful ranch. As the children moved away and the grandchildren grew up, the land required more and more work. When Adam's health declined, the family transferred 299 acres of their ranch into a Charitable Remainder Trust that would ultimately benefit Buckner and another of their favorite charities. The trust began paying monthly income to Susie and Adam for their lifetimes and to their children for a period of 20 years beyond their parents' lives. Even today, Buckner receives endowment income from this gift and many children, families and seniors are touched this ranch and the family that chose to share it.

Flexible Deferred Charitable Gift Annuities - Keven and Andrea+

Beginning in their mid-50's, Kevin and Andrea chose to make their annual Buckner gifts a bit differently. For 10 years they purchased "flexible deferred charitable gift annuities" that would benefit them with lifetime income later. These charitable annuities were structured to provide substantial tax-advantaged income beginning at Carl's retirement. Over the years, Kevin and Andrea took annual charitable deductions from their ongoing giving. When Kevin announced his retirement at age 67, he enjoyed the assurance that he would begin receiving tax-advantaged income to supplement their other investments. They derived greater satisfaction in knowing that Buckner, rather than a life insurance company, is the ultimate beneficiary.

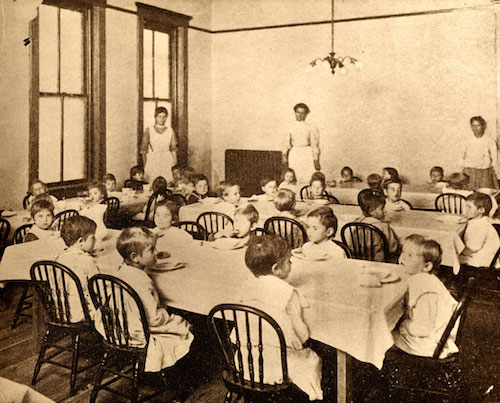

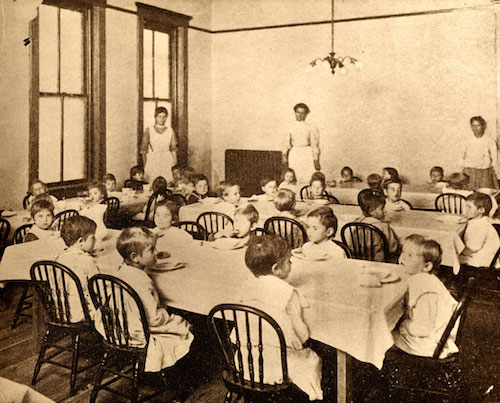

Toddlers at Lunch

Original cabin 1879 - Father Buckner on buggy

Girls' Brick Building

Buckner Bakery

Buckner Home 1932

Buckner boy at play